Unknown Facts About Opening Offshore Bank Account

Table of ContentsThe Of Opening Offshore Bank AccountThe Only Guide for Opening Offshore Bank AccountOur Opening Offshore Bank Account DiariesFascination About Opening Offshore Bank Account

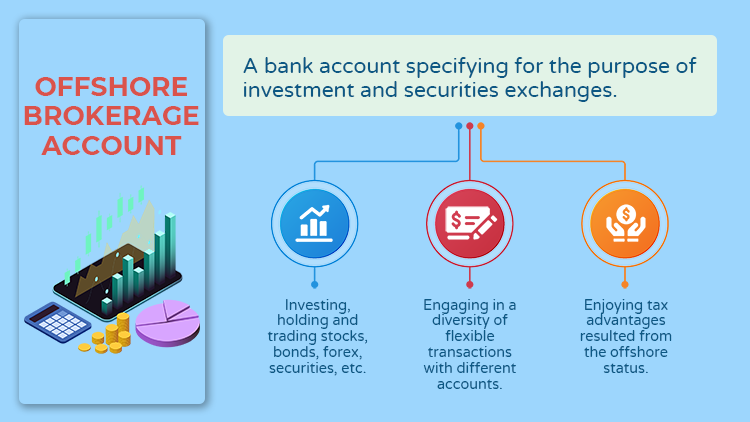

When you take component in offshore financial, you do so with a banks outside your home country. In order to open up an account with an overseas bank, you will certainly need to supply evidence of your identification and other documents to verify your identification. Financial institutions may also need info on the resource of your down payments.People that bank offshore do so in a part of the world outside their home country. As such, the term offshore banking is usually used to explain worldwide banks, companies, and investments. Some areas have ended up being popular areas of offshore financial consisting of Switzerland, Bermuda, or the Cayman Islands. Various other countries where offshore financial takes place aren't that typical such as Mauritius, Dublin, and Belize.

While many affluent people utilize these establishments, everyday people can do so too. As a matter of fact, you're banking offshore if you're an American that has a bank account in Canada. Offshore banking is usually reviewed in an unfavorable light. That's because several people use it as a way to hide their cash and prevent paying taxes.

Second, lots of offshore banks ask regarding the nature of transactions expected to occur via the account. This may appear excessively invasive, yet overseas banking centers have been under increasing stress to stop illegal task. For this purpose, many overseas banks want extra paperwork, keeping in mind the source of funds you are transferring in the financial institution.

Opening Offshore Bank Account Things To Know Before You Buy

The systems that allow complimentary digital transfers usual in residential banking are normally not able to move cash globally. Rates for cord transfers varies in between banks, so be sure to look for deals.

By doing this, electronic cord transfers can be made use of to transfer larger amounts of offshore funds to a domestic account where they can be easily accessed. This technique supplies higher personal privacy and safety, while likewise offering the convenience of neighborhood financial solutions. In spite of the aura bordering them, it is relatively straightforward to charge account with overseas financial institutions.

Picking the most effective currency and enhancing down payments and withdrawals are a little a lot more complicated, yet the most effective selections become clearer as you examine the options. When making use of overseas checking account and also receiving global wire transfers, it is very important to seek advice from with a tax specialist to guarantee This Site you are complying with all the tax regulations at house as well as abroad.

Not known Details About Opening Offshore Bank Account

Offshore financial is merely a term used to refer to the usage of banking solutions in an international territory beyond the nation where one lives. Any person who owns a financial institution account in an international nation outside of their country of house is involving in offshore banking. If you are a UK resident and open up an account in the US, that can be considered an offshore checking account.

That being stated, there are still specific territories (such as Singapore, Belize, Cayman Islands and also Switzerland) that are a lot more prominent for their use as good overseas environments that have an ideal blend site link of monetary advantages together with strong financial plans and techniques. Since each territory is one-of-a-kind they each have their own advantages and disadvantages as well as so the choice where to open up an offshore account will certainly vary according to individual needs and situations - opening offshore bank account.

If, however, you would love to open a personal account with a reduced down payment threshold, and also would certainly instead do it all online after that possibly Belize might function for you. Table of Component: Offshore financial gives a variety of benefits that can not be discovered in your regular residential banking system.

Why? We shall see soon. Financial in an offshore jurisdictionreduces your risk while increasing your economic liberty providing you flexibility as well as security image source of your properties. Lots of people recognise the importance of diversifying possessions, but few individuals think about expanding across various locations. There are a couple of different methods in which one can tackle opening up an worldwide savings account, along with various account types, which we will briefly explore: While it is feasible to open up a private overseas account in your very own personal name, it is usually recommended to integrate an overseas company in an international territory and also subsequently open a corporate account as the business.

What Does Opening Offshore Bank Account Do?

You will likely require a lot of documentation, referrals etc in addition to a large initial down payment, as well as even then there are no warranties of being approved. opening offshore bank account. Opening an account for an overseas company separates and dis-identifies you personally from the account. This implies that your possessions will be much safer and much less open up to unwanted attention.